Got Questions?

Before you miss out, check out how Accelerated Strategies has helped homeowners

just like you save time AND money on their mortgages.

Check Out Some Program FAQs

What If There's A Recession?

With ongoing global challenges—wars in Israel and Ukraine, a volatile economy with ups and downs—it’s natural to question whether our Accelerated Payoff strategy is still effective in these turbulent times. We hear you, and we understand the anxiety that comes with unsettling news headlines. We want to clarify why our strategy not only remains safe but also serves as a proactive shield to protect your finances during uncertain times.

Why Our Strategy Works, Even Now

At Accelerated Strategies, our program is designed to help you pay off your mortgage in as little as 5–7 years, save up to 70% on interest, and redirect those savings into investments like stocks, bonds, mutual funds, real estate or insurance. But beyond saving money, our approach offers stability and protection when the economy feels shaky. Let’s break down how it works and why it’s a smart choice, even in today’s climate.

Is Your HELOC Safe in a Downturn?

A common concern is, “What if the bank shuts down or freezes my Home Equity Line of Credit (HELOC) if the economy crashes, like in 2008–2012?” This is a valid question, but here’s why you can feel confident:

- Proven Track Record: Since 2015, we’ve served thousands of clients through our program, including during the COVID-19 pandemic. Not a single client has lost their HELOC or had it frozen. That’s a zero failure rate, which speaks to the reliability of our strategy.

- Dodd-Frank Act Protections: Post-2008, the Dodd-Frank Act (enacted in 2012) introduced consumer protections. Banks must now provide a 60-day notice before freezing or shutting down a HELOC. Additionally, banks are incentivized to lend within safe parameters, reducing the likelihood of defaults or freezes.

These factors make it significantly harder for banks to abruptly close your HELOC, offering you greater security than in past economic downturns.

Proactive Protection in a Crisis

Beyond stability, our strategy acts as a financial lifeboat during tough times, such as job loss or reduced income. Here’s how:

- Imagine you lose your job, as many did during the COVID-19 furloughs. With our strategy, you can tap into your HELOC to cover essential expenses—groceries, gas, utilities and even your mortgage or HELOC payments. This is called floating: you withdraw funds from the HELOC to your checking account to cover expenses and make payments back to the HELOC.

- This isn’t a long-term solution, but it’s designed to keep you afloat for 3–6 months while you pivot—whether that’s finding a new job or getting your business back on track. It’s a far better alternative to:

- Facing foreclosure

- Missing credit card or loan payments, which can damage your credit.

- Relying on mortgage forbearance programs.

Real-Life Example

During the COVID-19 pandemic, one of our clients—a school teacher—lost her income for three months when her school district stopped paying her. Using our strategy, she accessed her HELOC to cover groceries, bills and utilities. When she returned to work, she was back on track with minimal disruption. Yes, she lost a few months of progress, but she emerged unscathed, with no late payments or credit damage. We’ve seen similar success stories with other clients who used the HELOC as a temporary safety net.

A Shield for Financial Peace of Mind

Our strategy isn’t just about saving money—it’s a protective shield that gives you flexibility and peace of mind during turbulent times. When economic storms hit, the Accelerated Payoff approach provides:

- Wiggle room to cover essential expenses without defaulting

- Stability to avoid long-term financial damage.

- confidence that you're not alone in navigating uncertainty.

The Power of Community and Guidance

In times of economic uncertainty, going it alone can heighten stress and impair decision-making. That’s why Accelerated Strategies offers more than just a strategy—you get:

- A community of thousands of homeowners using the same approach.

- One-on-one coaching with our strategists to guide you through challenges.

- Weekly updates from our founders on the economy and how to stay on track.

- A voice of certainty to help you make informed, rational decisions.

When stress levels rise, having a mentor and a supportive community can make all the difference. We’re here to ensure you don’t make costly financial missteps in a fight-or-flight state.

Our Commitment: 180-Day Money-Back Guarantee

We stand behind our strategy with a 180-day money-back guarantee. If your mortgage balance doesn’t decrease faster than with traditional methods, we’ll refund your investment—no questions asked. Our goal is to deliver results and create happy, satisfied clients. If we don’t transform your financial outlook, we haven’t earned your trust or your money.

Take Action Now

With a storm brewing in the economy, waiting to “see what happens” could leave you exposed. Don’t get caught in the hurricane unprotected. Book a free call with us today to learn how our strategy can save you money, protect your finances, and provide peace of mind. During our call, we’ll:

- Show you exactly how much time and money you can save.

- Walk you through how we'll protect you in turbulent times.

- Answer any questions to ensure you feel confident and informed.

Final Thoughts

We know the world feels uncertain right now, but you don’t have to face it alone. At Accelerated Strategies, we’re committed to guiding you toward financial freedom with a strategy that’s both proactive and protective. Let’s work together to shield you from the storm and accelerate your path to a secure financial future.

What Happens If My HELOC Freezes Or Shuts Down?

Another common concern is, “What if my HELOC is frozen or shut down while using your strategy?” This is a valid question, especially for those who remember the 2008–2012 financial crisis. Let me address this in two ways: our track record and the legal protections in place.

Our Proven Track Record

Since 2015, Accelerated Strategies has helped thousands of clients pay off their mortgages faster and achieve financial peace of mind. In nearly a decade, not a single client has lost their HELOC due to a freeze or shutdown—not even during the COVID-19 pandemic. This zero failure rate reflects the safety and reliability of our strategy. We prioritize protecting our clients, ensuring they’re in a secure financial position, which also reflects our expertise.

Why HELOCs Are Safer Now

The 2008–2012 financial crisis saw many HELOCs frozen or shut down, often because banks were lending recklessly. Before the crash, banks offered 100% or even 120% loan-to-value (LTV) HELOCs, allowing borrowers to access funds far exceeding their home’s value. When real estate values plummeted by 30–50% or more, banks froze or closed HELOCs to prevent borrowers from drawing funds beyond their home’s worth.

Since then, significant protections have been put in place:

- Dodd-Frank Act and CFPB: In 2012, the Dodd-Frank Act established the Consumer Financial Protection Bureau (CFPB) and updated the Truth in Lending Act. These regulations require banks to provide a 60-day written notice before freezing or closing a HELOC, giving you ample time to adjust or secure an alternative.

- Conservative Lending Practices: Unlike the pre-2008 era, banks no longer offer 100–120% LTV HELOCs. Most now cap HELOCs at 90–95% LTV, and borrowers typically need to put money down. This reduces the risk of over-leveraging, making HELOCs more stable.

How Our Strategy Protects You

Our strategy isn’t about adding debt—it’s about paying it down faster. By using tools like HELOCs responsibly, we help you reduce your mortgage balance, making you less risky to banks. Banks primarily care about two things:

- Are you making payments on time?

- Are you over-leveraged? (Do you have too much debt relative to your assets and income?)

As long as you’re making timely payments and managing your debt responsibly, banks are unlikely to interfere. Our strategy is designed to keep you “bankable” while accelerating your path to financial freedom.

Can a HELOC Still Be Frozen?

While rare, a HELOC could be frozen or shut down if you:

- Default on payments

- Breach the loan agreement

- Engage in illegal activity (e.g., ciminal behavior).

As long as you stay current on payments and avoid trouble, your HELOC remains secure. Our strategy is recession-proof, offering both offensive benefits (saving money and time) and defensive protection (safeguarding your finances during tough times).

Our Commitment to Your Peace of Mind

At Accelerated Strategies, our mission is to help you make informed decisions with confidence. We want you to feel proud of your choice to work with us and excited about the results. Our success depends on happy, satisfied clients, which is why we go the extra mile to ensure you’re protected and supported.

If you’re ready to take the next step, book a call with us. We’ll answer your questions, walk you through the strategy and ensure you are comfortable with the process. If you have additional questions, check out our other FAQs for more insights.

We’re here to help you achieve financial freedom with confidence. Let’s make it happen together!

Is This The Right Strategy For Me?

If you’ve booked a discovery call with us or are considering it, you might be feeling a mix of excitement and anxiety. Maybe you’re eager to save money, pay off your mortgage faster and achieve financial freedom, but the idea of trying something new feels daunting. That’s completely normal, and we’re here to reassure you that you’re not alone—and we’re here to guide you every step of the way.

It’s Okay to Feel Anxious

Financial decisions, especially ones tied to your retirement, future and legacy, can bring up feelings of uncertainty or discomfort. This isn’t unique to you—it’s part of being human. We feel it too! For example, We’re currently training to become a private pilot, and let me tell you, there are moments of serious anxiety and nervousness. One wrong move in the cockpit could be costly, and while financial decisions might not be life-or-death, they carry weight. Your concerns are valid, and we take them seriously.

Growth Comes Through Discomfort

Think about the last time you learned something new—a job, a skill or even starting college. Chances are, you felt some anxiety or discomfort at the outset. But pushing through that discomfort led to growth: deeper insights, increased confidence and expanded capabilities. The same applies to your financial journey with Accelerated Strategies. By committing to explore our strategy—whether through watching our webinar, reviewing our materials or booking a call—you’re already taking courageous steps toward a brighter financial future.

We’re Here to Guide You

At Accelerated Strategies, we’re not just here to sell you a strategy; we’re here to be your guide. Many of our strategists and team members were once clients themselves, so they’ve walked the same path you’re on. They understand the unease of stepping into uncharted territory and are ready to support you. Our goal is to:

– Increase your confidence: Help you feel secure in your financial decisions.

– Expand your possibilities: Open doors to opportunities like real estate investments or other ventures.

– Build your financial foundation: Pay off your mortgage in as little as 5-7 years, giving you the freedom to pursue your dreams.

A Safe Space for Your Journey

Whether you’re feeling anxious or excited, our team is here to create a safe, pressure-free environment. During your free 30-minute discovery call, we’ll:

– Listen to your concerns and goals.

– Walk you through the Accelerated Payoff strategy at your pace.

– Ensure clarity and alignment with your financial objectives.

If our strategy isn’t the right fit, that’s okay! We’ll help you gain clarity and move forward with confidence. If it is a fit, we’re thrilled to work with you to save time, reduce debt and create the financial peace of mind you deserve.

Why Take the Next Step?

Committing to a call takes courage, but it’s a powerful step toward fighting for the future you’ve worked hard for. By exploring the Accelerated Payoff strategy, you’re investing in:

– Time savings: Pay off your mortgage years ahead of schedule.

– Financial freedom: Reduce debt and unlock new opportunities.

Peace of mind: Gain control over your financial future.

We’re excited to connect with you, guide you through this process, and help you build a future filled with financial confidence and opportunity. This journey might feel new, but it’s going to be exciting!

Next Steps

– Haven’t booked a call yet? Schedule your free 30-minute discovery call today. Our team is here to answer your questions without pressure, ensuring a win-win outcome.

– Already booked? Great job! If you’re feeling anxious, let us know during the call. We’ll make sure you feel comfortable and supported.

– Have questions? Check out our other FAQs for more insights or reach out to our team directly.

Does My Spouse Need To Be Involved?

As we help clients achieve financial freedom through our proven strategy, we often receive questions about the process. One common concern is whether your spouse needs to be present for our consultation call. Let’s dive into this topic to provide some clarity.

Do I Need My Spouse or Partner on the Call?

If you’ve booked a call with us, you might be wondering whether your spouse or partner needs to join. The answer depends on your situation, but here’s a breakdown:

- Required if your spouse is on the title or mortgage: If your spouse is a co-borrower or co-applicant on your mortgage or listed on the home’s title, we require their presence on the call. This ensures both of you are aligned on the financial strategy, as the house is legally binding to both parties. We want you both to be fully bought into the vision and plan for your financial future.

- Recommended for shared financial decisions: Even if your spouse isn’t on the title or mortgage, we strongly recommend including them if they’re involved in your household’s financial decisions. This fosters collaboration and ensures everyone is comfortable moving forward.

- Not required if you’re the sole decision-maker: If you’re the only one on the title and mortgage, and you handle the finances independently, your spouse’s presence isn’t legally necessary. However, we still encourage their involvement out of respect and to keep them informed.

Why Spousal Alignment Matters

Our experience shows that progress can slow when spouses aren’t on the same page. To avoid this, we prioritize open communication and collaboration. If your spouse can’t make the call, we’re happy to reschedule or arrange a follow-up to ensure everyone is aligned. Our goal is to help you and your partner feel confident and informed as you work toward financial freedom together.

Take the Next Step

If you’re ready to take the next step, book a call with us. We’ll answer your questions, walk you through the strategy and ensure you and your spouse (if needed) are comfortable with the process. If you have additional questions, check out our other FAQs for more insights. We look forward to being your partner in reaching financial freedom!

Where Can I Do More Research?

If you’ve watched our webinar, checked out our videos or read our glowing testimonials, you might be thinking, “I want to do more research before booking a call or becoming a client.” That’s a great approach! We want you to feel confident and comfortable with your decision, and we encourage you to dig deeper. It’s normal to feel some anxiety when exploring something new, but doing your homework can help you gain clarity and certainty. Here’s how you can research Accelerated Strategies to make an informed choice.

Start with Our Online Presence

We’re an open book at Accelerated Strategies, and there are plenty of ways to learn more about us:

– Youtube Channel: Our YouTube channel is packed with free content that explains our strategy and answers common questions. Simply search for “Accelerated Strategies YouTube” on Google, and you’ll find videos that dive into how our approach works, client success stories and tips for overcoming concerns like anxiety about new financial strategies. No subscription or payment required—just valuable information at your fingertips.

– Better Business Bureau (BBB) Profile: Check out our BBB profile to see our A+ rating and read through our reviews. We’re transparent about both the positive and the negative. Yes, we’ve had one complaint, which we owned up to as our mistake and resolved positively. Don’t just skim the five-star reviews—read the complaint and our response to see how we handle challenges with accountability and care.

– Trustpilot Profile: Our Trustpilot profile currently boasts over 300 reviews, with the vast majority being five-star ratings. Take a look at our excellent rating, but don’t stop there—read our one-star reviews too. We respond thoughtfully to every review, and we believe you’ll find our approach fair and reasonable. Transparency is key, and we want you to see the real us, warts and all.

– News Articles: You can also find news articles about Accelerated Strategies online. These provide third-party perspectives on our work and impact. Just be cautious—some opinions out there may come from individuals who don’t fully understand our strategy. If you come across something confusing or concerning, jot it down and bring it up during our call. We’ll address it honestly.

A Word of Caution: Not All Opinions Are Equal

While researching, you’ll likely encounter opinions about our strategy, brand or even founders personally. Some of these may be misinformed or lack context. For example, critics might not fully grasp the math behind our strategy or how our tools work. That’s okay—we’re here to clarify. If you find something that raises a red flag, bring it to your free 30-minute discovery call. Challenge us, poke holes and ask tough questions. We’ll provide straightforward answers to help you decide if we’re the right fit. If we can’t address your concerns to your satisfaction, that’s okay too—you deserve clarity.

Compare Us to the Competition

If you’re shopping around and considering other companies offering similar strategies, We encourage you to compare. Look at their reviews, customer service and what they offer. Here’s what sets Accelerated Strategies apart:

– Unmatched Customer Support: We provide 24/7 chat assistance, a feature you won’t find elsewhere.

– Personalized Guidance: You get weekly Zoom calls with our founders and a dedicated one-on-one strategist to guide you step-by-step.

– Advanced Tools: Our proprietary calculators track your progress and provide real-time recommendations.

– Proven Track Record: With nearly a decade in business and thousands of satisfied clients, our reviews speak for themselves.

We’re confident that our focus on customer service, transparency and cutting-edge tools makes us a top choice. But don’t take my word for it—check out the competition and see how we stack up.

Transparency Is Our Promise

Think of choosing Accelerated Strategies like entering a marriage—you want to work with someone who’s honest, authentic and transparent. We don’t hide anything. Our goal is to ensure that by the time you become a client, you know exactly what to expect. No surprises, just results. We want you to feel proud of your decision and confident in our partnership.

Take the Next Step

If you’ve already booked a call, fantastic! We’re excited to answer your questions, address any doubts and show you how we can save you time and money. Bring any concerns you’ve found during your research, and we’ll tackle them together.

If you haven’t booked yet, We hope this encourages you to keep researching and then schedule a free 30-minute discovery call. Click here to pick a time that works for you. We’ll dive into your financial situation, answer your question, and help you make a well-informed decision.

For more insights, check out our other FAQs, including one on managing anxiety around new financial strategies. We’re here to guide you toward financial freedom with clarity and confidence!

Can I Do This Alone?

A question we often hear is, “Why can’t I just do this on my own? I can research it on Google, figure it out and save money without your help.” It’s a fair question, and we get it—you’re smart, capable and want to take control of your finances. But let me explain why going it alone might not be the best move, using an analogy to put things into perspective.

The DIY Dilemma: Changing Your Own Oil vs. Managing Your Mortgage

Think about the last time you changed your car’s oil. Sure, there’s no law stopping you from doing it yourself. You could buy the oil, a drain pan, a lift and safety gear, and give it a go. But here’s the catch: if you use the wrong oil, skip a step or don’t have the right tools, you could damage your engine. That mistake might cost you a couple thousand dollars to fix.

Now, apply that to your mortgage and finances. Your home is likely your biggest asset, and mishandling a financial strategy could cost you tens of thousands of dollars in extra interest, penalties or missed opportunities. Just like changing your oil, you can try to implement our Accelerated Payoff strategy on your own, but the risks and time investment are significant. Let’s break it down.

- Time-Intensive Research: Researching a complex financial strategy takes hours, if not weeks, to understand fully. And how do you know the information you find online is accurate? Not everything on the internet is reliable and sifting through misinformation can lead to costly mistakes.

- Tracking and Calculations: Our strategy involves precise timing for moving money, such as making chunk payments or leveraging a Home Equity Line of Credit (HELOC). Without the right tools, how will you know if you’re actually saving money? For example, if you receive a $5,000 bonus and apply it to your mortgage, it changes the trajectory of your strategy. Tracking these variables manually is daunting.

- Choosing the Right Tools: Do you know which HELOC is best for our strategy? With over 3,500 clients and eight years of experience, we’ve identified which banks offer the right HELOCs and which don’t. Without this expertise, you might end up with the wrong financial product, derailing your progress.

- Execution Risks: Getting a HELOC is like buying a drill at a hardware store—easy enough. But using it correctly is another story. Do you know the exact steps for when to move money in and out? One misstep could cost you thousands in interest or fees.

The Accelerated Strategies Advantage

When you work with us, you’re not just getting a strategy—you’re getting a team of experts, proven tools and peace of mind. Here’s what you gain:

- Weekly Zoom Calls: Join our founders on Mondays and Wednesdays to ask questions and get real-time guidance.

- One-on-One Strategist: A dedicated consultant provides turn-by-turn directions tailored to your financial situation.

- Advanced Tools: Our proprietary calculator tracks your progress and gives real-time recommendations, like a GPS for your finances. Building something like this on your own would require significant technical expertise and resources.

- 24/7 Help Desk: Have a question? Our chat support is available anytime to keep you on track.

- Educational Resources: Our videos and modules break down the strategy in an easy-to-understand way, ensuring you’re informed and confident.

- Community Support: You’ll join thousands of homeowners who are successfully using our strategy, offering a sense of camaraderie and shared goals.

The Cost of DIY vs. Professional Help

Just like paying $30–50 for an oil change buys you peace of mind and saves you time, working with Accelerated Strategies ensures your financial strategy is executed correctly. Trying to do it yourself might save you upfront costs, but the risks—wrong HELOC, miscalculated payments or missed opportunities—could cost you tens of thousands in the long run. With your home and financial future at stake, is that a risk worth taking?

Our 180-Day Money-Back Guarantee

We’re so confident in our strategy that we offer a 180-day money-back guarantee. If your mortgage balance doesn’t decrease faster than a traditional amortization schedule after following our guidance, we’ll refund your investment—no questions asked. You either save money and win (which happens 99% of the time), or you get your money back. It’s a no-lose situation.

Why Expertise Matters

There are things you don’t know you don’t know—just like we wouldn’t try to build a rocket engine without consulting a rocket scientist. Our eight years of experience and over 3,500 clients give us the expertise to guide you safely and efficiently. We’ve seen what works, what doesn’t, and how to avoid pitfalls. Let us help you avoid costly mistakes and accelerate toward financial freedom.

Take the Next Step

If you’ve already booked a call with us, fantastic! We’re excited to meet you and customize our strategy to your unique financial situation. If you haven’t, click here to schedule a free 30-minute discovery call. We’ll dive into how we can save you money, answer your questions and show you the value of our expertise.

Don’t risk your financial future by going it alone. Let’s work together to ensure you’re making informed decisions with confidence. Check out our other FAQs for more insights, and we’ll see you on the call!

Why Can't I Just Pay Extra Into My Mortgage?

Paying extra into your existing mortgage can help reduce the principal and save on interest over time, but it has limitations compared to the Accelerated Payoff strategy. Below are the key reasons why the Accelerated Payoff concept may be a better strategy:

Lack of Flexibility with Extra Mortgage Payments

When you make extra principal payments on your mortgage, that money becomes inaccessible unless you pursue a cash-out refinance. This process involves:

– Closing costs: Including origination and application fees.

– Time delays: Typically 14-30 days to complete.

– Inconvenience: You may need funds immediately for emergencies or investment opportunities, and waiting isn’t practical.

In contrast, the Accelerated Payoff strategy uses a Home Equity Line of Credit (HELOC) or similar financial tools, allowing you to:

– Access funds quickly: Transfer money between your HELOC and checking account in seconds, often instantly if held at the same bank.

– Maintain flexibility: Withdraw funds as needed without costly or time-consuming processes.

Greater Interest Savings with Accelerated Payoff strategy

The Accelerated Payoff strategy can save significantly more interest than extra mortgage payments. For example, a real-life client, Dr. Deborah, compared the two methods:

– Extra mortgage payments: Might save $20,000 in interest.

– Accelerated Payoff strategy: Saved $102,000 in interest, with a similar payoff timeline. (Her story can be found here.)

This difference arises because the Accelerated Payoff strategy reduces the average daily balance on a line of credit, which calculates interest daily. Here’s how it works:

– Deposit your income: For example, depositing a $5,000 paycheck into a $10,000 HELOC balance reduces it to $5,000.

– Lower daily interest: Interest is calculated on the $5,000 balance for most of the month (e.g., days 2–29), not the original $10,000 or the end-of-month balance after expenses (e.g., $8,500 after withdrawing $3,500).

– Net result: Even if the net reduction seems similar to an extra mortgage payment (e.g., $1,500), the lower daily balance over the month significantly reduces interest costs.

In contrast, extra mortgage payments only reduce the principal by the amount paid, without leveraging the daily interest calculation advantage.

Additional Benefits of the Accelerated Payoff Strategy

– Liquidity and control: A revolving line of credit allows you to manage expenses and lifestyle needs while still reducing interest.

– Optionality in uncertain times: Having quick access to funds provides financial flexibility in volatile markets or unexpected situations.

Next Steps

To explore how the Accelerated Payoff strategy can benefit your specific financial situation:

By choosing the Accelerated Payoff strategy with Accelerated Strategies, you gain not just savings on time and interest but also greater financial flexibility and peace of mind.

– Use the Accelerated Strategies calculator to compare savings.

– Book a 30-minute discovery call to discuss your goals and see if this strategy is right for you.

– Review additional resources or videos for more details.

By choosing the Accelerated Payoff strategy with Accelerated Strategies, you gain not just savings on time and interest but also greater financial flexibility and peace of mind.

What If The Interest Rates Go Up?

A common question we’re hearing, especially with recent Federal Reserve interest rate hikes impacting mortgage rates, HELOC rates and credit card rates, is: “What happens if interest rates keep going up? Will your strategy still work?” It’s a valid concern, and we’re here to show you why rising rates don’t invalidate our approach. In fact, we’ll use example data to demonstrate how the Accelerated Payoff strategy remains effective, even in a high-interest-rate environment.

Understanding the Concern

With mortgage rates climbing and HELOC rates rising, you might worry that a strategy relying on a Home Equity Line of Credit (HELOC) could lose its edge. For example, if your mortgage is at 3–4% and HELOC rates are creeping up, does it still make sense to use our strategy? The short answer is yes, and we’ll prove it with a real-world example.

Crunching the Numbers: How Our Strategy Holds Up

Let’s walk through a scenario using our Accelerated Strategies calculator, which you can download here. This tool helps us simulate your financial outcomes and tailor the strategy to your specific situation.

Scenario 1: First-Lien HELOC

Imagine you have a $200,000 mortgage balance with a 3.75% fixed interest rate, resulting in a monthly principal and interest payment of about $1,200. Your monthly income is $8,000, and your living expenses (including property taxes and homeowner’s insurance) are $5,000.

Now, let’s assume you’re using a first-lien HELOC with a starting interest rate of 6.25%, and we’ll simulate an aggressive scenario where the HELOC rate increases by 0.5% annually (e.g., 6.25% to 6.75% to 7.25%, and so on). In reality, rates don’t rise indefinitely, but this stress-tests our strategy.

Results:

- Payoff Time: You’d pay off your mortgage in 7.3 years.

- Interest Savings: You’d save approximately $28,698 in interest.

- Effective Interest Rate: Despite the rising HELOC rates, it’s as if your mortgage had an effective rate of 3.32%—lower than your original 3.75%.

Even with rates climbing, you’re still saving significant interest and paying off your mortgage faster than the traditional 30-year schedule.

Scenario 2: Second-Lien HELOC with Chunking

Now, let’s try a second-lien HELOC with a higher starting rate of 8%, using our chunking method (e.g., applying $25,000 at a time to your mortgage). We’ll again assume the HELOC rate increases by 0.5% annually.

Results:

- Payoff Time: You’d pay off your mortgage in 6.5 years (by January 16, 2030).

- Interest Savings: You’d save approximately $57,000 in interest.

- Effective Interest Rate: It’s as if your mortgage had an effective rate of 2.89%—dramatically lower than your original 3.75%.

Even with a higher starting rate and annual increases, the second-lien HELOC outperforms, saving you more money and time.

What If Rates Stay Flat?

If HELOC rates remain constant (e.g., fixed at 8%), the results are even better. In the second-lien scenario, you’d still pay off your mortgage in 6.5 years, but you’d save closer to $58,000 in interest. The difference is minimal—about $1,000 less in savings with rising rates—showing that interest rate increases have a negligible impact on our strategy’s effectiveness.

Why Interest Rates Don’t Derail Us

The key takeaway is that our strategy is resilient to rising interest rates. Here’s why:

- Velocity of Money: Our approach focuses on accelerating mortgage payoff by leveraging tools like HELOCs to make strategic payments, reducing the time you’re paying interest.

- Customized Planning: Our expert strategists analyze your unique situation to determine whether a first- or second-lien HELOC (or another tool) is best, optimizing for savings even in high-rate environments.

- Proven Tools: Our calculator provides daily tracking and real-time guidance, ensuring you’re making the right moves regardless of rate fluctuations.

Rising rates might feel daunting, but they don’t undermine the core principles of our strategy. You’ll still save tens of thousands in interest and shave years off your mortgage.

Beyond Savings: Financial Freedom

Our goal isn’t just to save you money—it’s to liberate you from the burden of a long-term mortgage. By paying off your mortgage faster, you can redirect those savings into investments, passive income streams or retirement planning. This is about achieving financial peace of mind and breaking free from the “cage” of debt.

Take the Next Step

If you’re ready to see how our strategy can work for you, book a free 30-minute discovery call. We’ll dive into your specific numbers, answer your questions and provide a personalized plan to save you time and money. If you’ve already scheduled a call, we hope this video eases your concerns about rising interest rates. Bring your financial details to the call, and we’ll tailor our strategy to your situation.

For more insights, check out our other FAQs or videos on our YouTube channel. We’re here to help you achieve financial freedom, no matter the economic climate.

I Don't Trust You Guys

We want to address a common concern we hear from potential clients: trust. We understand the hesitation—many of you have been scammed or misled in the past, and it’s not a good feeling. We’ve all been there ourselves, purchasing products that didn’t live up to their descriptions or worse, dealing with businesses that took our money and disappeared. It’s frustrating, and we never want you to feel that way when working with us.

At Accelerated Strategies, our goal is to build a relationship based on transparency and trust. While we don’t expect you to trust us immediately, we do hope to show you why you can feel confident in getting to know us. Let’s dive into why Accelerated Strategies is a company you can rely on.

Our Commitment to Transparency: Reviews and Ratings

One of the best ways to gauge a company’s legitimacy is through independent reviews. We encourage you to check out our Trustpilot profile, where we currently have over 300 reviews, with the overwhelming majority being five-star and four-star ratings. These reviews are real, and you can read them for yourself—refresh the page, explore the feedback and even dive into our few one-star reviews. We don’t hide them. In fact, we invite you to read them and our responses to see how we address concerns fairly and transparently.

Additionally, we’re proud to be an A+ rated business with the Better Business Bureau (BBB), accredited since 2021. With additional reviews there, almost all of them five-star, our track record speaks for itself. We’ve been in business for seven years, and our longevity is a testament to our commitment to doing things right.

Why Our Longevity Matters

If Accelerated Strategies were involved in anything shady, illegal or unethical, we wouldn’t have lasted this long. Regulatory bodies like the Federal Trade Commission (FTC) and state attorney general offices would have intervened if we had a pattern of misconduct. The fact that we’re still here, openly sharing our story and showing our face (yes, that’s our founders on YouTube!), reflects our dedication to integrity. Our reputation—and more importantly, your trust—is everything to us.

Our Promise: Results or Your Money Back

At Accelerated Strategies, we operate with a clear code of ethics. If we don’t deliver the results we promise, we offer a money-back guarantee. It’s that simple. While some businesses prioritize profit over people, we believe in earning revenue by delivering real value. We know that our success depends on your satisfaction. If you’re not happy, we’ll make it right—or refund your investment.

Empathy for Your Experiences

We truly empathize with those of you who’ve been burned by other businesses. The frustration, anger and even guilt that come with being misled are real, and we’re sorry you’ve had to go through that. All we ask is for one opportunity to prove ourselves. If we don’t meet your expectations, we’ll honor our agreement and refund your money. Our goal is to build a long-term relationship, not a one-time transaction.

Do Your Research

We encourage you to research us thoroughly. Check out our Trustpilot and BBB profiles, read our reviews, and even do a background check on our founders, Sam and Daniel Kwak, if you’d like—they have nothing to hide. Sam says, “My faith guides my moral compass, and we strive to make decisions that reflect honesty and integrity. Don’t just take my word for it—Google us, explore our YouTube channel, and see what our clients are saying.”

Why Choose Accelerated Strategies?

Choosing to work with us isn’t about our team—it’s about you. Our mission is to help you achieve financial freedom, make informed investment decisions, and gain the education you need to see opportunities you might not currently recognize. Whether you decide to become a client today or in the future, we’re confident that partnering with Accelerated Strategies can be a life-changing step toward peace of mind and financial success.

Take the Next Step

If you’re ready to learn more, book a call with us. Pick a time and date that works for you, and let’s have a conversation. If you’re still on the fence, we hope this post has eased some of your concerns. Feel free to explore our other FAQs, YouTube videos, read our reviews, or reach out with any questions.

We’re excited about the possibility of welcoming you to the Accelerated Strategies family. Let’s work together to take your financial future to the next level.

I Feel Overwhelmed

If you’ve scheduled a discovery call with us, you might be feeling a mix of emotions—maybe excitement, but also a bit overwhelmed. The financial assessment, numbers and understanding the Accelerated Payoff strategy can feel like a lot to take in. And that’s okay! Whether you’re thinking, “This is a breeze, I’ve got this,” or feeling like a thousand things are coming at you, we’re here to support you.

It’s Normal to Feel Overwhelmed

First, take a deep breath. Feeling a little anxious or uncertain is completely normal when you’re diving into something new, especially when it involves your finances. Our goal is to make this process as comfortable as possible for you.

We Move at Your Pace

If you’re feeling overwhelmed, don’t worry—we don’t want you to feel pressured or uncomfortable. Here’s how we can help:

- Need to slow down? Just let us know, and we’ll adjust to your pace.

- Need more time to prepare? Reach out to reschedule your discovery call. We’re happy to accommodate you to ensure you feel ready and confident.

That said, we want to avoid getting stuck in a cycle of endless rescheduling. Why? Because the sooner you take action, the faster you can start saving time and money on your mortgage, moving closer to your financial freedom and retirement goals.

Our Commitment to You

At Accelerated Strategies, we’re here to serve you. Our priority is helping you pay off your mortgage faster, save on interest and achieve your financial goals—whether that’s early retirement, financial peace of mind or something else entirely. We’re not here to rush you or make you feel like you’re moving at a thousand miles an hour. Tell us how we can best support you, and we’ll make it happen.

Next Steps

- Have questions? Check out our other videos for more insights and tips.

- Need help with scheduling? Reach out if you have conflicts or need to adjust your call time.

- Ready for your call? Great! We’re excited to connect and dive into your specific financial situation.

We’re eager to meet you during your discovery call and help you take the next step toward financial freedom. If you’ve already booked, just show up with your questions—we can’t wait to answer them! If you’re ready to book your call, you can do that HERE!

I Have A Low Fixed-Rate Mortgage And Inflation Is High

A common question we hear is: “I have a low fixed-rate mortgage—say, 2.5% or 3%. With current HELOC rates at 7–9%, does the Accelerated Payoff strategy still make sense for me?” The short answer is yes, and we’re going to show you why using real numbers from our calculator. Let’s dive in!

The Scenario: Low Fixed-Rate Mortgage

Imagine you have:

– Original mortgage balance: $250,000

– Current balance: $200,000

– Fixed interest rate: 3% (a greate rate!)

– Loan term: 30 years

– Monthly principal and interest payment: $1,054.01

– New monthly income: $8,000

– Monthly expenses (including taxes and insurance, excluding mortgage payment): $5,000

– HELOC: $25,000 (10% of original mortgage balance) at an initial 8.5% interest rate, increasing by 0.5% annually (a conservative stress test).

This scenario assumes a worst-case situation with rising HELOC rates to ensure we’re evaluating the strategy realistically.

The Results: Significant Savings

Using the Accelerated Payoff strategy, our calculator estimates:

– Payoff date: December 16, 2030 (6.4 years from August 18, 2024)

– Original interest cost (without strategy): $71,000

– New interest cost (with strategy): $26,000

– Total savings: $45,158.10

That’s nearly $45,000 saved—equivalent to a year’s tuition at a top university! More importantly, you could pay off your mortgage in just 6.4 years, freeing you up to focus on investments, savings, passive income or legacy planning well before retirement.

Why It Works: It’s Not About the Interest Rate

You might wonder how this is possible with a low 3% mortgage rate and a higher 8.5% HELOC rate. The key is that interest rates aren’t the main factor. The real enemies are balance and time. The Accelerated Payoff strategy saves you money by:

– Reducing the average daily balance: By depositing your entire income (e.g., $8,000 monthly) into the HELOC, you lower the daily balance, which reduces interest costs since HELOC interest is calculated daily.

– Shortening the payoff timeline: Paying down the principal faster cuts the total interest paid over time.

– Maintaining flexibility: Unlike extra mortgage payments, which lock your money away, a HELOC allows you to withdraw funds instantly for emergencies or opportunities, giving you control and peace of mind.

In this example, the effective interest rate feels like 2.45% due to the interest savings, even with a 3% mortgage and an 8.5% HELOC.

Try It Yourself

Don’t just take my word for it! You can use our free calculator to run your own numbers and see the potential savings. This transparency ensures you understand exactly how the strategy works for your situation.

Does It Make Sense for You?

Even with a low fixed-rate mortgage (2–3.5%), Accelerate Strategies can save you significant time and money. Our strategy is designed to:

– Maximize savings: Reduce interest costs and shorten your mortgage term.

– Provide flexibility: Access funds when you need them without costly refinancing.

– Empower you: Gain control over your financial future.

If you haven’t booked a call yet, click here to schedule a 30-minute personalized session. We’ll dive into your specific financial situation and determine if this strategy is right for you. If you’ve already booked, great—you’re 80% there! This information should put your mind at ease, knowing that even with a low-rate mortgage, we can help you save.

Our Commitment

At Accelerated Strategies, we’re focused on helping you make informed decisions. We don’t just want you as a client—we want you to feel confident that this strategy aligns with your goals. That’s why we’re proud to be A+ rated by the Better Business Bureau and have over 300 five-star reviews on Trustpilot.

Next Steps

– Run the numbers: Use our free calculator to see your potential savings.

– Book a call: Schedule a 30-minute discovery call to explore how we can help you save time and money.

– Have questions? Check out our other FAQs or reach out to us directly.

We’re excited to help you pay off your mortgage faster and achieve your financial goals. See you on the call!

What About The Tariffs?

With recent headlines buzzing about tariffs, trade wars and market downturns, it’s no surprise that many of you are feeling uneasy or uncertain about the economy’s direction. Whether you support tariffs or not, the noise and volatility can leave you wondering: Should I wait it out? Invest more aggressively? What if I make the wrong move? Let’s cut through the confusion and focus on what you can do to take control of your finances during these uncertain times.

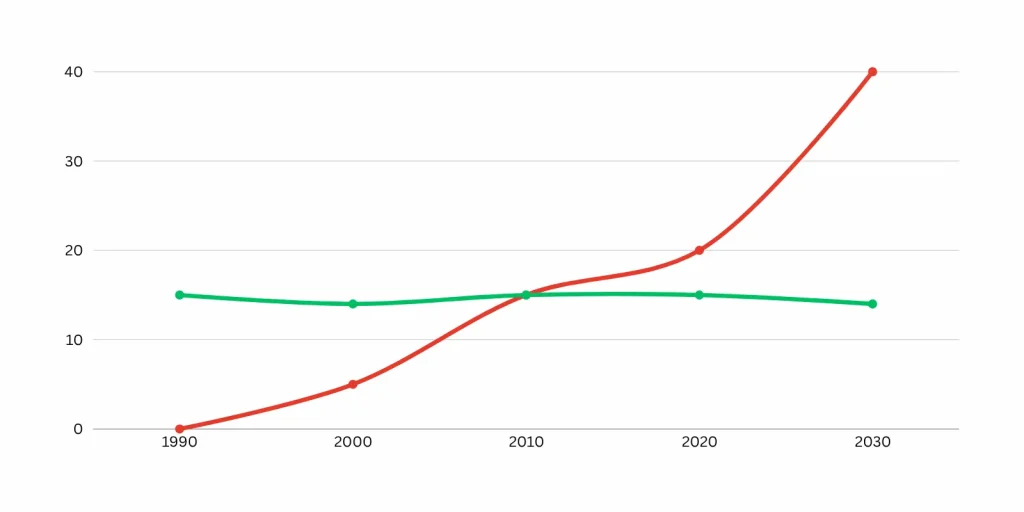

The Current Economic Landscape

You’ve likely noticed the markets taking a dip, perhaps even feeling the impact in your 401(k), IRA or investment portfolio. While short-term market fluctuations, driven by tariff threats or other uncertainties, can feel alarming, a look at the 10-year Dow Jones average shows a clear upward trend despite occasional dips. Historically, markets recover and reach new highs when the dust settles. This perspective is critical to avoiding knee-jerk reactions.

Don’t Fall for Sensationalism

News outlets often amplify stories to grab attention, exaggerating risks to drive clicks and ad revenue. This creates availability bias, where constant coverage makes issues like tariffs or market drops seem more critical than they are. While these topics are important, don’t let sensational headlines push you into impulsive financial decisions. The media’s goal is to capture your attention, not to guide your financial strategy.

Tariffs Are Not New

Tariffs have existed for centuries as part of global trade. They come and go, often as temporary negotiation tactics or diplomatic levers. Many of the tariffs currently discussed will not be permanent and are unlikely to cause long-term economic disruption. History shows we’ve navigated tariffs before, and we will again.

What Should You Do?

In times of economic uncertainty, the best approach is to cut through the noise and create a proactive financial plan to mitigate risk. At Accelerated Strategies, we advocate for our Accelerated Payoff strategy, which can help you:

- Pay off your mortgage in as little as 5–7 years: Owning your home free and clear significantly reduces your financial vulnerability.

- Increase economic immunity: By eliminating debt, you’re better shielded from market downturns, tariffs or other economic storms.

- Build a strong foundation: A debt-free status allows you to pursue investments and passive income with less risk.

Our mission is to empower you with a personalized strategy that puts you in control. By reducing debt and minimizing exposure to economic volatility, you can make confident financial decisions regardless of what’s happening in the White House, Congress or global markets.

Why Act Now?

Waiting out the uncertainty might feel safe, but it could cost you time and money. The sooner you implement a strategy like the Accelerated Payoff concept, the faster you can:

- Eliminate your mortgage and other debts,

- Protect your finances from economic fluctuations.

- Focus on building wealth, whether through investments, savings or legacy planning.

Next Steps

If you’ve already scheduled a discovery call with Accelerated Strategies, fantastic! We’re excited to work with you to create a tailored plan that enhances your financial control and clarity. If you haven’t booked yet, we invite you to schedule a 30-minute call today. We’ll discuss how to:

- Protect your finances from economic storms.

- Create a custom plan to pay off your mortgage quickly.

- Empower you to make informed decisions with confidence.

Don’t let fear or uncertainty hold you back. We’re excited to connect with you, guide you through this process, and help you build a future filled with financial confidence and opportunity.

What If I Don't Have A Home?

Are you thinking about buying a home but wondering if you can start using the Accelerated Payoff strategy before closing on a mortgage? Good news—you don’t have to wait! In this post, we’ll explore the Purchase HELOC, a powerful tool that lets you finance your home purchase directly with a Home Equity Line of Credit (HELOC), potentially saving you time, money and hassle.

What Is a Purchase HELOC?

A Purchase HELOC is exactly what it sounds like: a HELOC used to finance the purchase of a home from the outset. Instead of taking out a traditional 30-year or 15-year fixed-rate mortgage and then applying for a HELOC later to accelerate your payoff, you can use a HELOC as your primary loan to buy the house. This streamlined approach eliminates the need for two separate loan applications, saving you both time and effort.

Benefits of a Purchase HELOC

- Simplified Process: By applying for a single HELOC instead of a mortgage plus a separate HELOC, you reduce paperwork and streamline the financing process.

- Lower Closing Costs: Many lenders offer Purchase HELOCs with low or even no closing costs, making it a cost-effective option compared to traditional mortgages.

- Flexibility for Accelerated Strategies: A Purchase HELOC sets you up to use the Accelerated Payoff strategy from day one, potentially paying off your home faster and saving on interest.

How to Get Started

If you’re intrigued by the idea of using a Purchase HELOC to buy your home, here’s what you can do:

- Evaluate Your Fit: Not every lender offers Purchase HELOCs, and not every borrower qualifies. Working with a financial professional can increase your chances of success.

- Learn the Strategy: The Accelerated Payoff strategy, when paired with a Purchase HELOC, requires careful cash flow management to maximize savings. Professional guidance can help you navigate this process effectively.

- Schedule a Free Consultation: Curious if a Purchase HELOC is right for you? Click here to schedule a free call with our team. We’ll walk you through how much time and money you could save, answer your questions and determine if this strategy aligns with your financial goals.

Why Work With Us?

At Accelerated Strategies, we specialize in helping homebuyers and homeowners leverage tools like the Purchase HELOC to achieve their financial dreams. During our 30-minute free consultation, we’ll:

- Explain how the Purchase HELOC works and how it fits into the Accelerated Payoff strategy.

- Assess whether you’re a good fit for this approach and if we’re a good fit to work together.

- Provide personalized insights into potential time and interest savings.

Take the Next Step

Ready to explore the Purchase HELOC and start your homebuying journey with a strategy that could save you thousands? Schedule your free consultation today. Let’s work together to make your homeownership goals a reality!

What If I Don't Have Any Equity?

One of the most common questions we get is, “I don’t have enough equity in my home. Can I still use the Accelerated Payoff strategy to pay off my mortgage faster?” The answer is a resounding yes! Even if you have little to no equity, you can still leverage this powerful strategy using a personal line of credit (PLOC) instead of a home equity line of credit (HELOC). Let’s dive into how this works and share a real-life success story to show you what’s possible.

What If You Have Zero Equity?

Many homeowners, especially first-time buyers or those using programs like Veterans Affairs (VA) loans, start with little or no equity in their home. For example, if you purchased your home with a zero-down payment loan, you might think you’re stuck waiting to build equity before using the Accelerated Payoff strategy. But that’s not true! A personal line of credit can be a game-changer, allowing you to start paying down your mortgage faster without relying on home equity.

Real-Life Success: Rick’s Story

Rick, a Navy doctor financed his home with a VA loan and zero money down, leaving him with zero equity initially. Rick felt discouraged, thinking he couldn’t use the Accelerated Payoff strategy. But when we introduced him to the idea of using a personal line of credit, everything changed.

Here’s what Rick achieved:

- After One Month: Using his PLOC, Rick saved $12,471 in interest and shaved 8 months off his mortgage.

- After Two Months: By making a $25,000 “chunk” payment toward his mortgage principal using his PLOC, Rick saved approximately $30,000 in interest and cut an additional 21 months off his mortgage.

In just two months, Rick saved nearly $42,000 in interest and reduced his mortgage term by over 2.5 years. These results, achieved back in 2020, have likely grown even more impressive as he continued the strategy.

How Does a Personal Line of Credit Work?

A PLOC is an unsecured line of credit offered by banks or credit unions, which you can draw from as needed and repay over time. Unlike a HELOC, it doesn’t require home equity, making it ideal for homeowners with high loan-to-value ratios. By using a PLOC strategically, you can make large “chunk” payments toward your mortgage principal, reducing interest costs and shortening the loan term—similar to how a HELOC works in the Accelerated Payoff strategy.

Once your home’s loan-to-value ratio reaches about 90% (or 10% equity), you can consider switching to a HELOC for potentially lower interest rates or continue with the PLOC if it’s working well. The key is managing cash flow effectively to maximize savings, which is where professional guidance can make a big difference.

Why It’s Worth It

Rick’s story shows that even with zero equity, the Accelerated Payoff strategy can yield significant results. While using a PLOC may involve extra steps, such as securing the line of credit and carefully managing repayments, the savings in time and money are well worth it. Rick’s $42,000 in interest savings and 2.5-year reduction in his mortgage term prove the power of this approach.

Ready to Get Started?

If you’re excited about paying off your mortgage faster, even with little or no equity, our team is here to help. Here’s how you can take the next step:

– Schedule a Free Consultation: Click here to book a no-pressure, no-obligation call with us. We’ll analyze your specific financial situation and show you how much time and money you could save using a personal line of credit.

– Learn the Strategy: We’ll guide you through the process, just like we did with Rick, to ensure you implement the Accelerated Payoff strategy correctly and maximize your results.

– Start Saving: Whether you use a PLOC or transition to a HELOC later, we’ll help you create a plan tailored to your goals.

Final Thoughts

Don’t let a lack of home equity hold you back from paying off your mortgage faster. With a personal line of credit, you can start using the Accelerated Payoff strategy today and achieve results like Rick’s. Schedule your free consultation to see how much you could save, and let’s work together to make your financial goals a reality!

What If I'm Living Paycheck to Paycheck?

Living paycheck to paycheck is a reality for many—reports from sources like MSNBC suggest that 75-78% of Americans find themselves in this situation. But what does it really mean to live paycheck to paycheck? And more importantly, how can you break free from this cycle? In this post, we’ll explore the two types of paycheck-to-paycheck lifestyles, practical steps to regain control of your finances, and how our program can guide you toward a healthier financial future.

Understanding the Paycheck-to-Paycheck Trap

There are two distinct groups of people who live paycheck to paycheck:

- The "Thin Ice" Group: These individuals allocate every dollar they earn to essential expenses—housing, utilities, groceries and other necessities. There’s little to no room for error, and unexpected costs can create serious financial strain.

- The "Spend, Spend, Spend" Group: This group may have some positive cash flow but falls into the trap of spending any extra money they see in their checking account. Whether it’s $100 or $500, they view it as "extra" and splurge on dinners, vacations or other non-essential purchases without a clear budget.

Both situations are challenging, but the good news is that there are actionable steps to help you regain control, no matter which category you fall into.

Strategies for Breaking Free

For the “Thin Ice” Group

If every penny is spoken for, the key is to optimize your cash flow and reduce financial burdens. Here’s how our program can help:

- Recovering Expenses: We’ll show you how to identify areas where you can cut costs without sacrificing your quality of life. This could include negotiating bills, refinancing high-interest debt, or finding overlooked savings opportunities.

- Prioritizing Debt Repayment: Not all debt is equal. We’ll guide you on which debts to pay off first to free up cash flow quickly, allowing you to redirect those funds toward building financial stability.

- Building Efficient Cash Flow: By restructuring your finances, we’ll help you create a small but meaningful surplus that can be used to start implementing wealth-building strategies.

For the “Spend, Spend, Spend” Group

If you’re spending every extra dollar without a plan, it’s time for a mindset shift and some discipline. Our program offers:

- Controlled Budgeting: We’ll help you create a realistic budget that aligns with your goals while still allowing for some enjoyment. No need to cut out your favorite activities entirely—just make them intentional.

- Creating an "Intentional Accident": This means planning for fun expenses like dinners or movies instead of impulse spending. By making deliberate choices, you can enjoy life without derailing your financial progress.

- Lifestyle Preservation: We understand you don’t want to feel deprived. Our approach ensures you can maintain your lifestyle while building a stronger financial foundation.

Why Our Program Works for Everyone

Whether you’re on thin ice or just spending too freely, our program is designed to meet you where you are. We provide tailored strategies to help you move from financial stress to financial security. Yes, there may be extra steps involved, but these steps are designed to set you up for long-term success—think of them as investments in a fruitful, healthy financial future.

Take the Next Step

Ready to break free from the paycheck-to-paycheck cycle? Schedule a call with us today to discover how much time and money you could save using our proven strategies. Click the green button below to book your consultation and ask any questions you may have. Whether you’re looking to recover expenses, pay off debt or create a disciplined budget, we’re here to help you take control of your finances and build a brighter future.

Let’s get started— Click here to schedule your call now and take the first step toward financial freedom!

What About Geopolitical Instability?

With global events like wars, pandemics and economic turmoil dominating headlines, it’s natural to wonder how to safeguard your finances in such uncertain times. Questions like, “What effect will trade tariffs have on the stock market?” or “How will ongoing conflicts like Russia’s invasion of Ukraine affect my financial strategy?” are top of mind for many. At Accelerated Strategies, we understand these concerns, and our strategy—centered around using a Home Equity Line of Credit (HELOC)—offers both offensive and defensive tools to help you stay financially secure, no matter what’s happening in the world.

Why our Accelerated Payoff Strategy Works in Any Climate

Our Accelerated Payoff strategy is designed to save you time and money, but it’s more than just a wealth-building tool. It’s a powerful defense mechanism that provides flexibility and protection during economic crises. Here’s how it works and why it’s more critical than ever to implement it now.

A Real-Life Example: Surviving the COVID-19 Crisis

During the COVID-19 pandemic, the U.S. economy took a significant hit, with effects that will linger for years. One of our clients, a school teacher, faced a two-month furlough with no income and minimal savings. Without a backup plan, she could have faced severe financial hardship—late credit card payments, missed bills or even defaulting on obligations.

Fortunately, she had a first-lien position HELOC in place. This financial tool acted as a lifeline, allowing her to cover essential expenses like groceries, gas and minimum debt payments during those challenging months. When she returned to work, she bounced back quickly, using our strategy to continue saving money and time. Without the HELOC, she would have been left without options, potentially spiraling into debt or financial ruin.

This story illustrates the power of having a safety net in place. A HELOC provides the flexibility to weather unexpected disruptions, whether it’s a job loss, a pandemic or even larger global events.

The Defensive Power of the Accelerated Payoff Strategy

In times of crisis—whether it’s a war, political turmoil or economic instability—banks prioritize protecting their own interests, not yours. High loan-to-value ratios (e.g., 80-90% of your home’s value) make you a riskier borrower in their eyes. When banks feel threatened, they may freeze or shut down lines of credit, leaving you vulnerable.

Here’s how our strategy helps you stay ahead:

- Reduce Your Risk Profile: By paying down your mortgage using our Accelerated Payoff strategy, you can significantly lower your loan-to-value ratio. The more equity you have in your home, the less risky you appear to banks, reducing the likelihood of your HELOC being frozen or restricted.

- Build a Financial Parachute: A HELOC acts as an emergency fund, giving you access to cash when you need it most. Whether it’s covering living expenses during a crisis or avoiding missed payments, this flexibility ensures you’re never left without options.

- Protect Against Volatility: Global events like wars or economic downturns can destabilize markets, but having more equity and a HELOC in place gives you a buffer to navigate uncertainty without sacrificing your financial stability.

Over the past five to six years, none of our clients have had their HELOCs shut down or frozen, even during turbulent times. This track record speaks to the reliability of our approach, especially when paired with proactive debt reduction.

Why Now Is the Time to Act

With rumors of war, political unrest and ongoing global challenges, now is not the time to be complacent. High debt levels make you a target for banks looking to protect their bottom line, often at the expense of consumers. By reducing your debt and building equity, you position yourself in a place of strength, insulated from the whims of financial institutions.

Our Accelerated Payoff strategy does more than just save you money—it empowers you with control, options and peace of mind. It’s about creating a financial safety net that allows you to sustain your lifestyle, even in the face of catastrophic events.

Take Control of Your Financial Future

Don’t wait for the next crisis to catch you off guard. Our Accelerated Payoff strategy gives you the tools to protect your finances, reduce debt and build wealth, all while maintaining the flexibility to handle whatever comes your way. With limited consultation slots available, now is the time to act.

Click here to schedule a call with us. We’ll create a personalized game plan to help you save money, reduce risk, and secure your financial future. Whether you’re worried about global instability or simply want to gain more control over your finances, we’re here to guide you every step of the way.

Take charge today—schedule your call and start building your financial fortress!

Claim Your Spot Now!

This is the moment of decision – your chance to leap ahead of the queue! Our 30-minute qualification calls are almost at capacity. Secure your priority access before the doors close, and start your journey to financial liberation today!