Your Mortgage Is Robbing You of a Secure Retirement

Your Mortgage Is Robbing You of a Secure Retirement

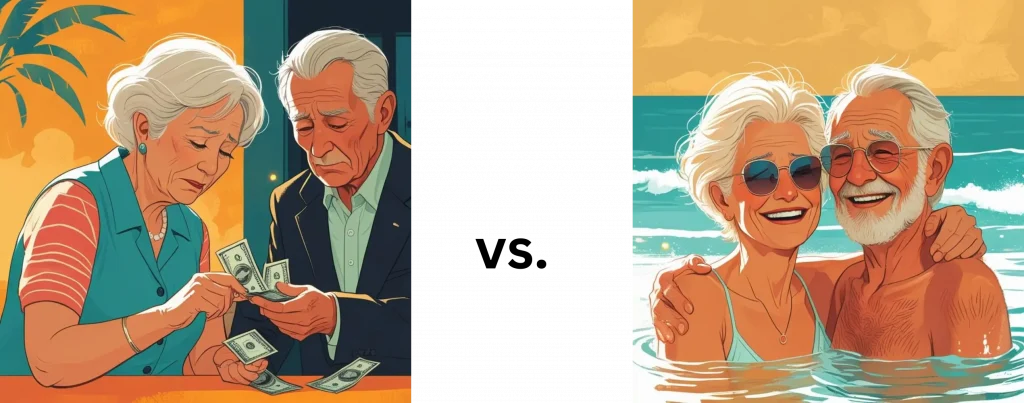

As a homeowner, you’re likely making monthly mortgage payments, with 20, 25, or even 30 years left to go. But with retirement approaching in the next 10 to 15 years, you may be wondering: Can I pay off my mortgage in time to enjoy a debt-free home, travel, spend time with family or invest more in my 401K, IRA or savings? At Accelerated Strategies, we’ve worked with countless clients who share this concern. In this post, we’ll uncover a shocking truth about how mortgages are structured and how they could delay your retirement dreams—unless you take action.

The Mortgage Trap: Front-Loaded Interest

All mortgages, whether 15, 20, or 30 years, operate on an amortization schedule. This is the process of paying off your loan with fixed payments over time, covering both principal (the loan balance) and interest. However, the way these payments are structured can feel like a trap.

How Amortization Works

– Principal: The actual loan balance. Paying down the principal builds equity and reduces the interest you owe over time.

– Interest: Calculated as a percentage of your remaining loan balance. In the early years of your mortgage, most of your payment goes toward interest, not principal.

For example, if you have a $1,000 monthly mortgage payment with a 4-5% interest rate, around $750 of your first payment might go toward interest, with only a small fraction reducing the principal. This is known as the front-loaded interest zone, where the bulk of your interest payments occur in the first 10 years. During this period, you’re barely chipping away at the loan balance, meaning banks and lenders get paid first while your equity grows slowly.

Why This Matters

According to the U.S. Census Bureau (2010), the average American moves 11.7 times in their lifetime—roughly every 6-7 years. If you move within the first 10 years of your mortgage, you’ll likely start a new 30-year mortgage, resetting you to square one where most of your payments again go toward interest. The same happens if you refinance your mortgage, even if it’s to secure a lower interest rate. Refinancing to another 30-year term restarts the amortization clock, keeping you in the front-loaded interest zone.

This cycle—moving or refinancing—means you’re essentially renting your home from the bank, often extending payments well beyond retirement. For many homeowners, this is the ultimate retirement killer.

The Cost of Staying Trapped

The front-loaded interest structure can cost you thousands in interest and add years to your mortgage, delaying your ability to:

– Retire debt-free

– Travel or spend time with family

– Save or invest in your 401K, IRA or other financial goals

Without awareness of this trap, you risk prolonging your mortgage far beyond what you planned.

A Solution to Break Free

The good news? There’s a way to escape this cycle and pay off your mortgage faster—potentially in as little as 5-7 years. At Accelerated Strategies, we’ve helped clients achieve this for nearly a decade. By using proven strategies, you can:

– Accelerate your principal payments

– Minimize interest costs

– Build equity faster

To learn how, we’ve put together a free webinar that reveals the exact steps to pay off your mortgage quickly and reclaim your financial freedom. Join our webinar here: acceleratedstrategies.com/free-virtual-class/

Take Control of Your Financial Future

You deserve a retirement where you can travel, spend time with loved ones and live in a home that’s free and clear. Don’t let the mortgage trap delay your dreams. By understanding how amortization works and taking proactive steps, you can pay off your mortgage faster and secure the future you envision.

For more details, join our webinar or reach out to Accelerated Strategies for personalized guidance. Let’s work together to make your debt-free retirement a reality!

Pages

Get In Touch

3809 Illinois Ave STE 100

St. Charles, IL 60174

- Email: Info@acceleratedstrategies.com

- Phone: (630) 635-5689

© 2025 All Rights Reserved